A guide to the use of the Balanced Startup framework.

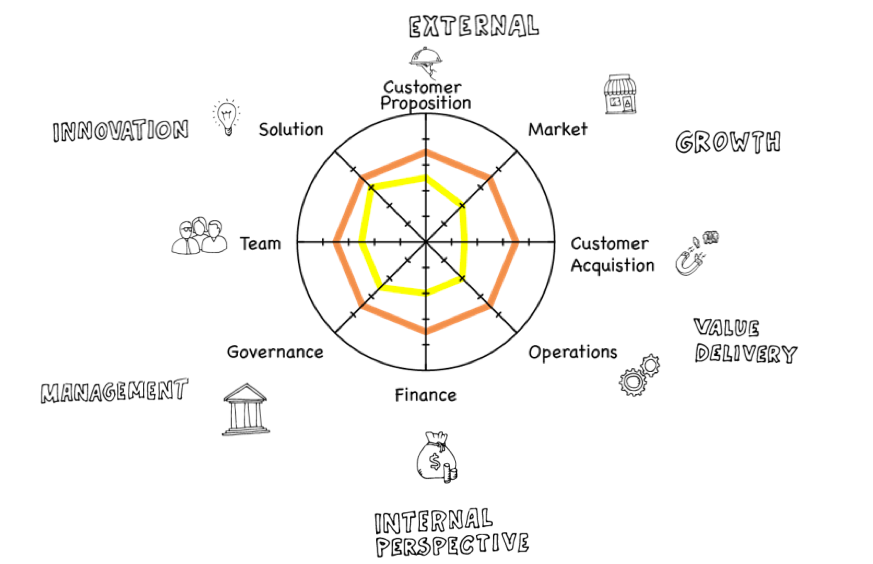

So how do we use it? To the left, a diagram of The Balanced Startup is shown.

The framework consists of 8 sections in which a startup should aim to be equally developed in each. By drawing on the ideas of the balanced scorecard and using a radar style plot, a diagram has been created to rate a startup's development in 8 key areas.

Creating a visual representation of this allows us to see gaps, innovations, strengths and weaknesses in a companies business model. Where the line goes close to the centre shows low development in the corresponding area which may highlight an area of a startup that needs focus, funding or development.

The Balanced Startup can help communicate and share these perspectives with a common frame of reference.

Solution

Customer Value Proposition

The challenge of finding a problem or opportunity that is worth solving should not be underestimated. To develop a compelling customer proposition requires real insight into the customers' problem/opportunity, the pros and cons of their options and a clear, concise and compelling characterisation of the benefits delivered by your solution.

Market Opportunity

Getting paid for solving a problem or helping a customer capitalise on an opportunity means there is a market of one for your solution. If your business is to grow, however, then the question is - how many more customers are out there that look like this one? Yes, you could win them all, but then there is the question of who else is trying to win them - the competitors who are chasing the same customers with a similar proposition to yours.

Customer Aquisition

A polite term for sales? Yes, selling is key to acquiring customers (and their money!) but there are some important questions for startups… like where to start? Early customers bring more than just the money, they can be rich in information and say a lot about the future potential of the business. Is there a compromise between your ideal customer and the ones that you can get access to when you don't have a track record? What is the path between the two?

Operation Capabilities

Doing things on a shoestring is the name of the game in a startup, right? This certainly applies to how things get delivered to the first, second, third customers as you fine-tune what it takes to deliver on the promise made in your customer proposition. Starting from the MVP (Minimum Viable Product) also means starting with the minimum viable operations to support it, and staying alert to balancing the need to delight customers with adding only product functions and operational cost that delivers back real value and market opportunity.

Financing

For ambitious startups, finding funding continues from day 1 until exit… way beyond the magic moment when the trickle of revenues grows to match the operational costs - scaling the business to the next stage of growth will already be on the cards. The finances and the financial model that drives them provides the ultimate acid test of the business model and plays a key role in the investor proposition - and your strategy to acquire the necessary funding.

Governance

A grand term, governance encompasses everything a startup does to direct, manage and control the company and its resources.

Read more on the importance of governance and management systems.

Team

The founder or founders in a startup have to navigate the challenge of establishing and growing a team that has the right mix of skills to execute at each stage of development as the startup morphs and scales up right through to an eventual exit. Notoriously this is challenging in even in the least challenging of business environments. But the nature, dynamics and pressure of the startup are what make this a unique challenge - finding the blend of personality and skills for the business at "A" and to take it to "B"… then to re-build and re-shape to go again from B to C.. only to miss C, lose some key staff and to have go again but with E as the new target. The excitement, dynamacism, flexibility and risk-taking that goes with starting a company are not always as valued as companies grow, and the skills need to find opportunities are not the same as those needed to focus on exploiting opportunities to the full.